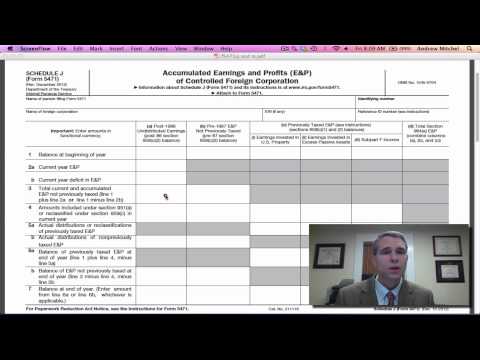

Hi, my name is Andrew Mitchell. Today, I'm going to talk about Schedule J of Form 5471. Schedule J tracks the earnings and profits of controlled foreign corporations. At the top of the schedule, you just have the name of the person filing the Form 5471 and their identifying number. You also have the name of the foreign corporation and its employer identification number if it has one, though typically they don't. There's also a reference ID number, which is just a number you make up to track multiple foreign entities. It helps keep track of which entity is which. Line 1 is the balance at the beginning of the year, and there are multiple different categories. These include post-1986 earnings, pre-1987 earnings, and previously taxed earnings. Previously taxed earnings typically occur if there has been subpart F income or investments in U.S. property. Excess passive assets were a thing in the mid-1990s, but they are no longer around, so you typically don't see previously taxed earnings related to them. Previously taxed earnings refer to when there has already been subpart F income in a prior year, and that income has previously been taxed to the U.S. owners. These earnings are tracked in three columns. Additionally, there is a total earnings column. Line 2a represents current earnings, while line 2b shows a deficit if there is one. Line 3 is simply a subtotal of lines 1a and 2b. Line 4 represents a current year subpart F income inclusion or a current year investment in U.S. property. The amount is typically recorded in column a and columns c1 or c3 to indicate that earnings are being reclassified from non-taxed earnings to previously taxed earnings due to being taxed as subpart F income or as an investment in U.S. property. Line 5...

Award-winning PDF software

1040 (Schedule J) Form: What You Should Know

Schedule J (Form 1040) Individual Income Taxes for Farmers Schedule J: Personal Business Expenses Schedule J: Business Expenses Schedule J: Business Expenses is the second portion of your Schedule J. Personal business expenses are expenses incurred in conducting the business through the operation of your business, and are primarily for business necessities and business-related expenses. Business expenses can include equipment, software, lease payments, inventory and supplies, royalties paid, and any of the business expenses to which you are entitled to claim an allowable deduction with respect to your business. The only expenses that are allowable as personal business expenses are those you incurred to carry out a trade or business. Personal business expenses must be incurred and incurred within 90 days after you file your tax return. The business expenses for personal business must be incurred and incurred within 90 days after you file your tax return. How To Use Schedule J: Personal Business Expenses The personal business expenses must be incurred and incurred within 90 days after you file your tax return. See how to figure Schedule J personal spending on page 10 of your personal tax return. What's The Difference Between Business and Personal Business Expenses? The difference between business and personal business expenses is how much you use personal business expenses to reduce taxable income or to reduce your corporate tax liability. Taxable income includes your business income and any tax withheld from your wage. Your corporate tax is the tax that is withheld from your corporate checks. This information is in your Form W-2. Your expenses are the money you paid for business-related expenses. These include your personal business expenses which you don't report in your tax return. For example, expenses for travel, equipment, and supplies used to carry on your business. How To Enter Your Personal Business Expenses In addition to your business expenses, you must include these on your personal tax return if the expenses exceed 20% of your total earnings from self-employment. See Personal business expenses in 2017, 2018, and 2025 on pages 21, 22, 23 of your personal income tax return or the table below. What are Some Examples of Personal Business Expenses & Related Business Expenses? Enter the appropriate amounts here (See Examples of Personal Business Expenses on Form W-2 by Year). Example 1 The expenses are for car depreciation. The expenses are for car depreciation. Example 2 The expenses are for business supplies. The expenses are for business supplies. Example 3 The expenses are for office overhead.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 (Schedule J), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 (Schedule J) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 (Schedule J) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 (Schedule J) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1040 (Schedule J)